Whether you own your company, are looking to lead a project in the organization you are employed by, or serve clients as a marketing consultant, I’m going to share with you my exact process for revitalizing the consumer experience.

You can go through this process in an agile sprint manner, or as an ongoing process throughout the year. My recommendation is along six-weeks, so I will frame it accordingly.

The outcome we are looking for is in two parts: discovering purchasing patterns and seeking impacts and innovations. Let’s begin.

Week 1: Consumer Experience Diagnostic

Always begin a new project of significance with a diagnostic of the situation. This can take place through a 60-90 minutes meeting with relevant stakeholders. This audience should involve the leadership team, such as the business owner, CEO and divisional heads.

In this meeting, begin physically mapping out the consumer experience:

- decide what stages are involved in the consumer’s buying experience,

- outline the channels used to communicate with the consumers throughout the stages,

- begin noting early understandings of each stage and what the consumers do, think, and feel during them

The result of this should be a detailed framework that can be expounded upon. This deliverable allows you to discover innovative and unique ways to augment the process, making it easier for consumers to buy, to pique interest and excitement, and to translate that excitement into initial sales and repeat buys. This may increase sales cycles or conversions from prospect to buyer or both, resulting in exponential growth through a tangible innovation process.

Week 2: Interview Employees in Marketing, Sales, and Customer Service

This meeting has the same premise as the initial meeting, but we now have a new audience. That also means we will start fresh: no original stages, touchpoints, or data that we collected in the first meeting.

We do this because we want an unbiased review. It will be more beneficial in this stage to start with a clean slate and fresh perspective, removing blocks that allow us to discover unique innovations in how we do business today. Innovations today are necessary to stay ahead of the competition tomorrow.

Week 3: Consumer Interviews

What you and your team think, say, and discover is important. There’s no questioning that.

However, you also want to dig deeper into what the consumer does, thinks, and feels. In their own words, too. That’s what this is all about, after all. The consumers.

Conduct a series of interviews to explore and understand the consumer better, co-creating solutions, extra value-added services, and innovative process changes.

The structure of the interviews are important, but it is exhaustive to have detailed in this article. The questions posed must be strategic, systematic, and scientific, and yet personal in the approach.

Within the interviews, you will discover what stages exist in the buying cycle, what activities, thoughts, and feelings go along with each stage, and what true motivations and barriers are most salient to the consumer.

You will now combine the findings from your diagnostic, your internal stakeholder interviews, and your customer interviews. This is true collective intelligence.

Week 4: Competitive Intelligence

Now, you will have three vital perspectives on the consumer experience: from the leadership, the consumer-facing staff, and the consumers themselves.

With a strong understanding of the stages, the channels, the touchpoints, and what the consumers do, think, and feel along the way, you can proceed to introduce the fourth stage: competition.

As this information coalesces, we need to compare it to competitors:

- What are they doing that we are not?

- What are we doing that they are not?

- How do their consumers differ, if they do?

- How does their company differ from us, if they do?

- What are industry leaders doing (may not necessarily be our direct competitors)?

- What other industries should we look to for inspiration who may share similar consumers, buying processes, or services, offerings, and outcomes?

Collect these findings in the framework of what you already know based on your mapping of the stages. Use that to focus your thoughts and exploration as you examine these questions. It may require a mix of reviewing past interviews, first-hand “shopping” of competitors, and research conducted online.

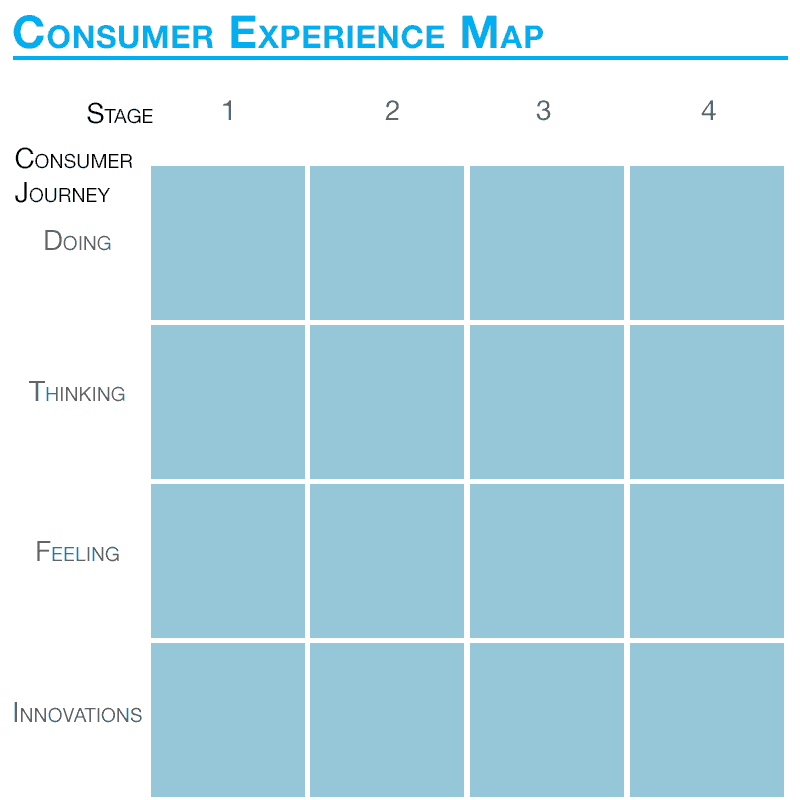

Week 5: Consumer Experience Cartography

With all of the information you nee collected, you can begin to organize it in such a way that provides more clarity and full perspective to those viewing this data.

We do this by developing a map — joining the disciplines of Cartography with Marketing, Sales, and Innovation.

This Consumer Experience map provides a physical, tangible framework for us to understand the consumer experience and buying process. This incorporates everything the consumers do, think, and feel.

Your consumer-facing teams — marketing, sales, and customer service — will find this to be an invaluable tool. It provides confidence, conviction, and clarity.

The immediate value will reveal itself as you discover innovations from the map, serving as a graphical representation of data, as well as its creation process.

In the Consumer Experience Map, our focus is on the stages and what the consumers do, think, and feel at each. This deepens our understanding, empathy, and ability to develop customer-centric innovations (and marketing campaigns, and sales materials).

This is a high-level connection and view of the consumer. For specifics, we develop a Consumer Touchpoint Map.

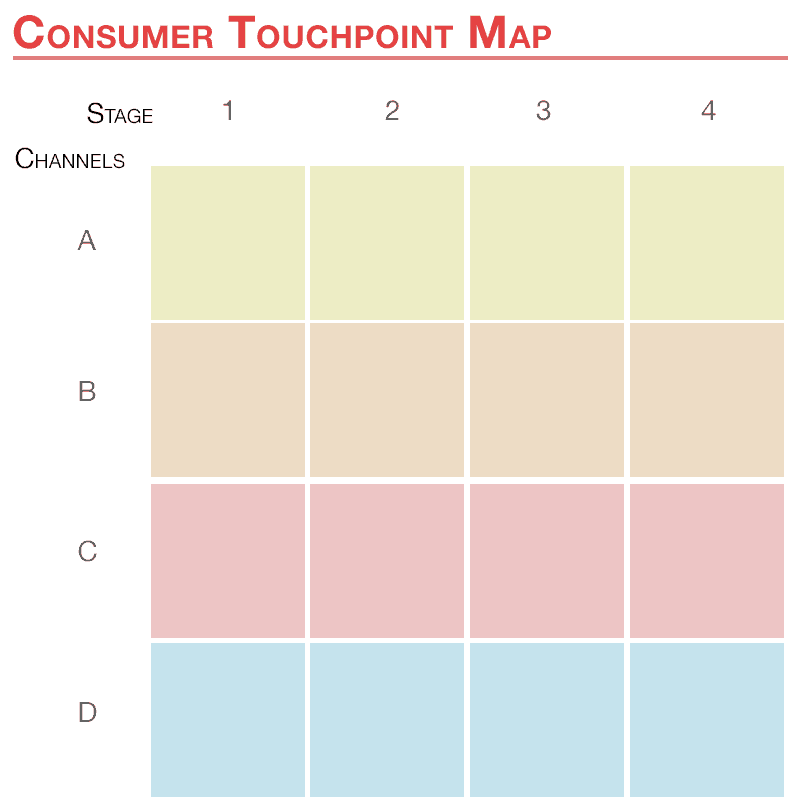

Week 6: Consumer Touchpoint Map

Touchpoints focus on what actually happens at each stage and in each channel used to communicate with consumers. It’s in the details.

This allows you to see the activities that coalesce with (or bifurcate from) what consumers want and expect. You also gain a clearer vision of what is not being performed that is desired, or what is not being done that can generate new untapped markets and demand.

Touchpoints may include any interaction with a consumer: product packaging, retail store visits, website traffic, branded content, digital services, and so on…

With each touchpoint, seek to understand how each marketing activity relates to what consumers think, do, and feel.

Ask yourself:

- What can we do that’s unique?

- What can we do that makes an impact on the consumer experience?

- How can we make the sales process more sophisticated to meet what the consumers really want? That means shifting focus away from solution selling (much worse if you are still pushing features instead) and focusing on making the buying process as easy and seamless as possible — “insight selling”.

- Your job isn’t just to be the expert on your product. Your job is to be the expert on the buying process: How does your customer easily transition to your offerings? How can you anticipate emerging demand? Not just focusing on finding the decision-maker, but also who the decision-advancer is that can mobilize troops to make that decision?

- In short: don’t be the salesman to the prospect. Be the coach.

- At each touchpoint, what are you communicating? Is your messaging consistent and relevant?

Depending upon your situation, you may explore additional options:

- Expand this exercise to a brand development project

- Review your positioning strategy

- Remove touchpoints that are not necessary or actually harmful

- Introduce added-value touchpoints that will revolutionize your industry, increase consumer relationship breadth and depth, or even add an element of commonsense previously overlooked

- Change touchpoints so that they perform more effectively and efficiently, while providing an improved consumer experience

You Can Make Innovation Real in Six-Weeks

Admittedly, innovation is a term tossed around too often. However, you rarely hear the term paired with a process for how to actually achieve it tangibly in organizations. Here, you have an actionable concept, rather than an academic theory.

Think about making this a reality in your organization.

Do you want to discover innovations that lead to untapped demand in new markets, faster sales cycles, and increased conversions from prospects to consumers?

I recommend you follow this process. There are more details to consider, but you have the framework for a systematic and strategic way of deepening your understanding of consumers, what makes them tick, their purchasing patterns, and the impacts and innovations you can make on them, leading to the prospect of exponential growth.

Most businesses move along slowly because they continue to seek out 10% improvements. And while helpful, it is in the 10x transformations that the most successful companies emerge.

Put this process to use. Discover your own 10x transformations.